In the Early 1900s, Albert Einstein upended science and gave the scientific community a new perspective on time and space. For centuries, scientists followed Isaac Newton’s theory that space and time were fixed. Einstein showed that time and space were not separate, but intertwined, like two sides of the same coin. So, what does this have to do with investing?

For so long investors have adhered to the idea of investing in a balanced portfolio, more commonly known as the 60/40 portfolio. Investors have always succumbed to a long standing, but outdated view on constructing investment portfolios. In following this rigid mentality, investors have always focused on minimizing risk alone and not on maximizing the risk-adjusted return of a portfolio. I’m no Einstein, but my goal is to convince you and the investing community that risk and return are intertwined, just like time and space. By changing the way investors look at risk and return, we can move on from the ridiculous concept of a balanced portfolio.

For years as a portfolio manager, I’ve told family, friends and clients about how absurd this framework is, and now I’m telling you. It’s a ubiquitous and silly rule that makes no sense for most investors. And yet that’s the “go to” asset allocation model that investment advisors have used for decades, so-called balanced portfolios: 60% in equities and 40% in bonds and it doesn’t stop there.

Ditching the 60:40 portfolio and any variation of it would be a huge step in the right direction for helping investors create better portfolios that align with their goals.

I’m going to break it down and explain why.

The 60:40 portfolio focuses on minimizing risk and forgets return

This is the problem with this type of portfolio. It doesn’t focus on the investor’s risk-adjusted return. Instead, it treats risk and return like two mutually exclusive natural forces, just like how space and time was treated before Einstein’s theory of relativity.

What’s frustrating, is that unlike physics, this should be a simple concept for investors to grasp. We know that it’s important not to take unnecessary risks. But in life you need to take risks if you ever want to progress and achieve your goals. Taking risk is an important experience in life. Sometimes you need to take a risk if you want a decent return.

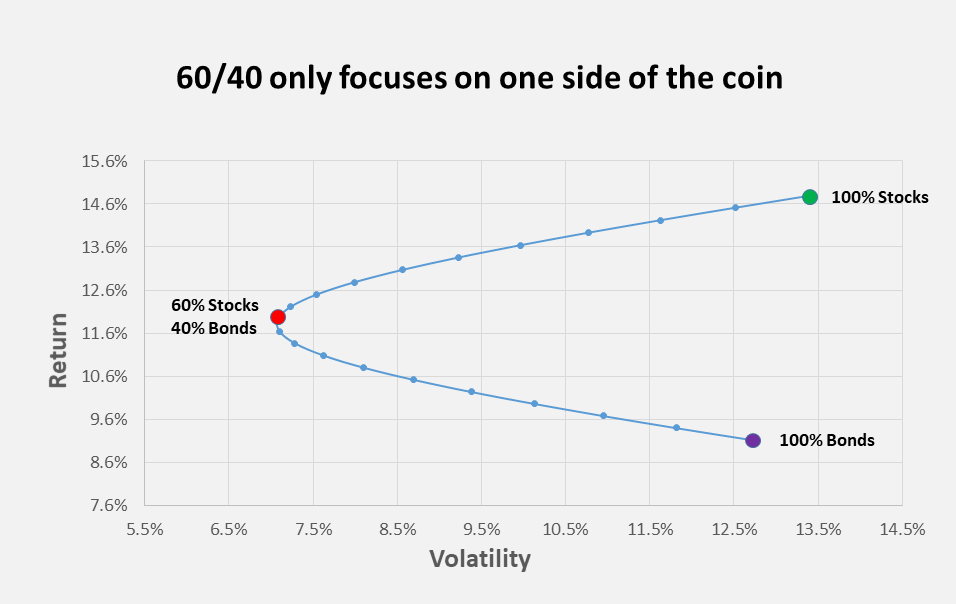

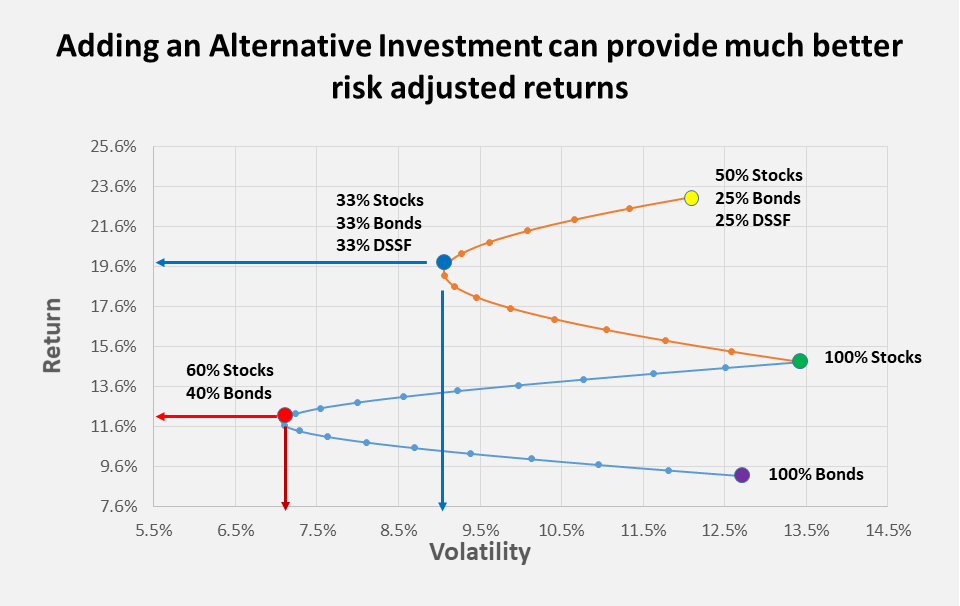

Take a look at the chart below. The top part represents the efficient frontier. It has been constructed by combining different combinations of equities (I’ve used the SPDR S&P 500 ETF Trust) and bonds (Here it’s the iShares 20 Plus Year Treasury Bond ETF) over the past decade.

As you can see, the 60:40 portfolio sits right at the furthest most tip of this efficient frontier. Out of all the combinations of equities and bonds that an investor could choose, this portfolio minimizes risk. Source: Factset

Common sense tells us, that as you get older, you should take less risk. The famous founder of Vanguard, John Bogle, once said,

“My favorite rule of thumb is to hold a bond position equal to your age—20 percent when you are 20, 70 percent when you’re 70, and so on—or maybe even your age minus 10 percent. There are no hard-and-fast rules here.”

However, this quote makes no sense. It’s bad advice. The chart shows that for the same risk you could have a much better return over the last decade. It demonstrates that increasing your bond allocation as you get older is not prudent, especially if you still have a long time horizon. For the same level of risk, you could be at the top end of the curve, getting a much higher return! Over the past decade, holding 100% bonds is just as risky as holding 95% equities! Chew on that for a while.

You are going to unnecessarily miss out on returns that could help you reach your investment goals. If you are a parent, this could mean not being able to pay your children’s tuition fees. It could also mean you might never be able to own your own home, or even be able to retire.

If your time horizon is 20 years plus, then why should you minimize risk and rigidly hold onto a 60:40 portfolio? It defies logic.

The problem is we have been in a 40-year bond bull run

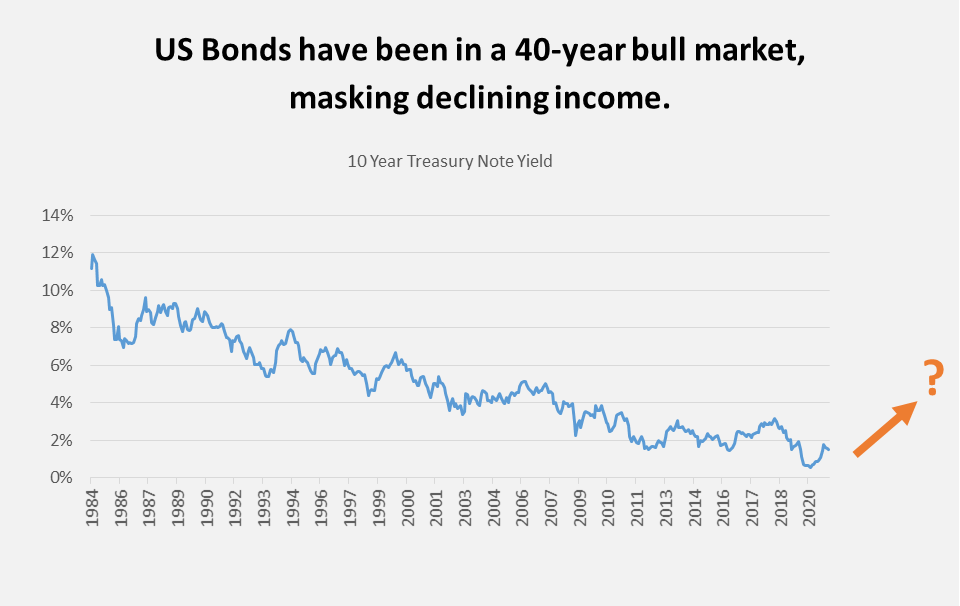

If you look at the chart below, Treasury yields have been trending downward for the last 40 years. This bond bull market has acted as a tailwind that has masked the declining income that this asset class offers. The rise in bond prices has in other words, offset lower yields.

To make matters worse, with interest rates so low, there are now considerable convexity issues across the US yield curve. Even a moderate rise in yields, could result in an extreme change in bond prices (a.k.a. volatility). The best-case scenario right now is that yields stay low, while bonds offer little income and merely act as a drag on portfolio returns. Source: Factset

Let’s play devil’s advocate

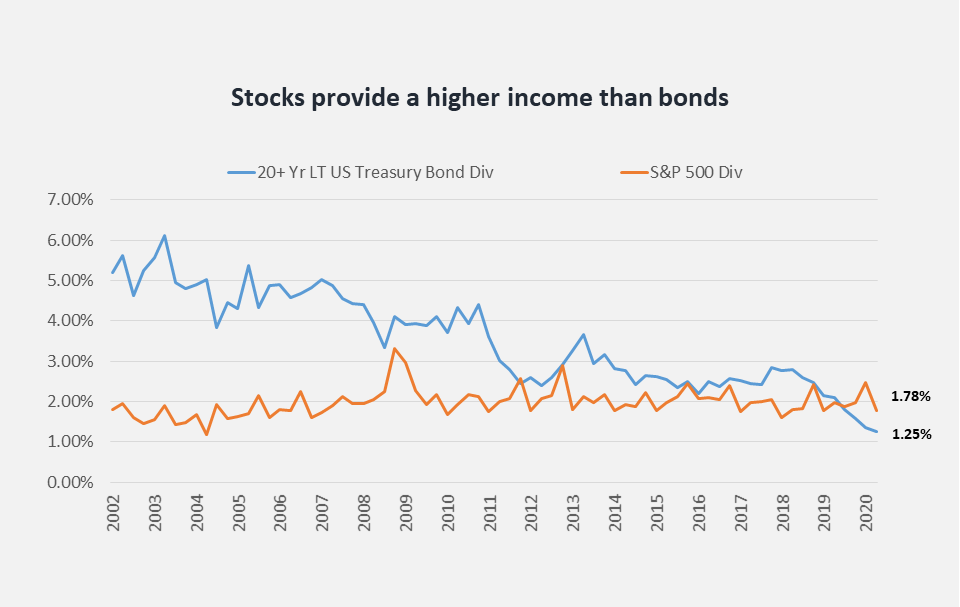

You might be thinking, I don’t invest in bond just for safety, I invest for the income. The other point to note is the contrast between equity yields and U.S. Treasury yields over the last 20 years. You can clearly see the convergence between the yields these two asset classes offer. Source: Factset

This closing gap clearly indicates that the risk landscape has changed over this twenty-year period. So why on earth would you want to stick to a rigid 60:40 equity-bond allocation during this period? It doesn’t make sense.

Not only are investors avoiding potential returns that are well within their risk budget, but they are also failing to adapt dynamically to the constantly shifting risk environment that they face. There are now significant convexity issues with interest rates so low that really need to be addressed. Sticking to a 60:40 portfolio right now is actually risky.

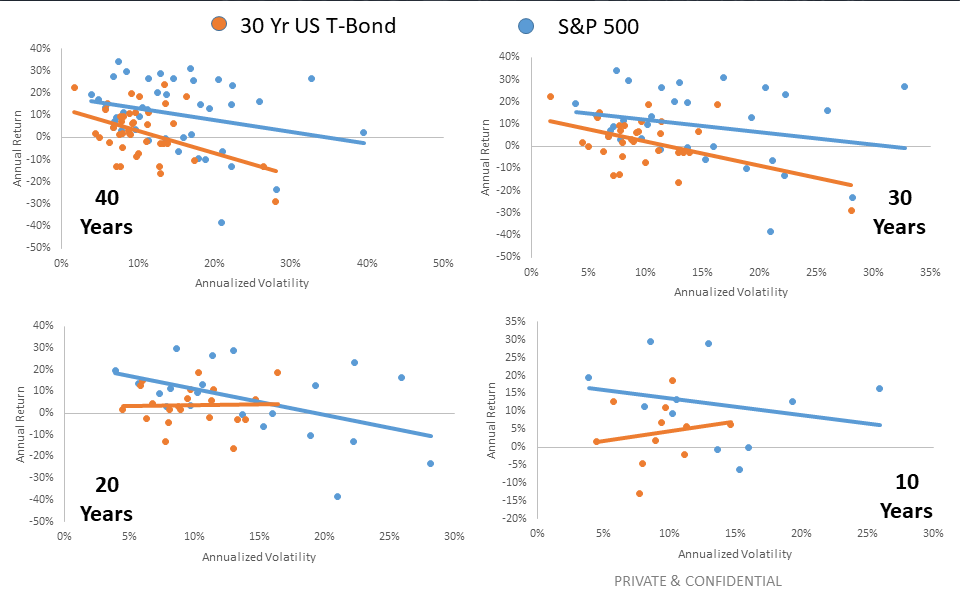

The chart below shows how volatility in the bond market has gradually increased over time. The risk-return trendline for bonds has shifted from being downward sloping to upward sloping as the time period is shortened. Over the last decade, higher returns in bonds have coincided with higher volatility. This is not a good characteristic of an asset class that is meant to lower risk.

Where is the safety net?

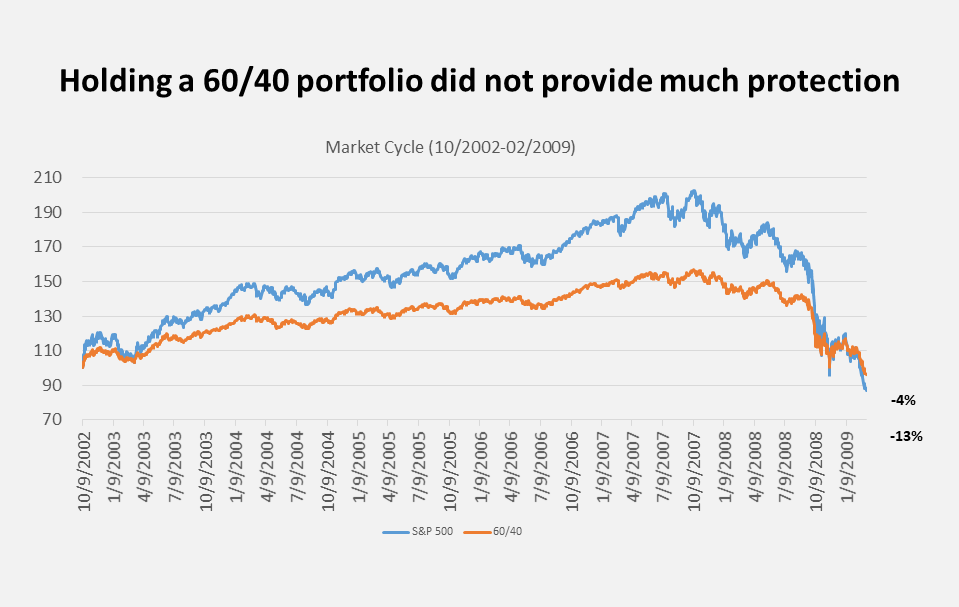

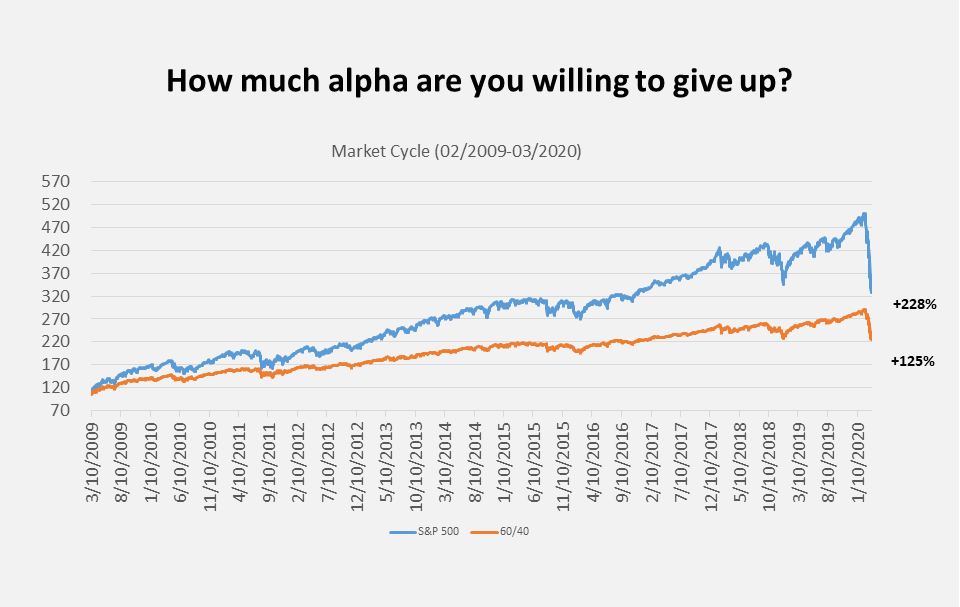

When you look over the last 20 years, you can see that over two full market cycles, adopting a 60:40 portfolio would not have helped investors as shown in the two charts below. It would have failed to meaningfully protect investors against market declines during the financial crisis (first chart) and hurt investors by giving up the opportunity to earn alpha through the pandemic (second chart).

From the beginning of the bull market starting in 2009 through the bottom of the pandemic low, the S&P 500 index still outperformed the 60/40 portfolio by over 100%! That is a lot of alpha to give up.

So what’s the solution? Investors need to start thinking more like Einstein and start thinking differently. They need to be nimbler and more open-minded, and stop thinking in simplistic asset allocation buckets that consist of just equities and bonds. Both asset classes are extremely diverse and there are plenty of opportunities to exploit. Sticking rigidly to a 60:40 allocation is not only just an oversimplification, but it glosses over the diversity and opportunities that present themselves to active investors.

For instance, if you added the fund our firm manages to a plain-vanilla equity and bond portfolio, the risk-return characteristics of your portfolio would look very different. In fact, the entire efficient frontier would shift upwards, offering investors much better risk-adjusted returns. By adding our strategy, an investor would increase their returns by 8%, from 12% to 20%, by adding only 2% more volatility. That is a big jump in risk adjusted returns for an investor’s portfolio.

You therefore need to treat risk and return as part of the same dimension, rather than mutually exclusive events. Minimizing risk makes no sense if it comes at the cost of your future returns and prevent you from reaching your goals. Likewise, pursuing the highest returns with little regard to risk is just as foolish.

If you have rigidly stuck to a 60:40 portfolio, then looking at this chart you might feel time has passed you by and you are behind relative to where you could be. It’s annoying and frustrating, but the story doesn’t end there. Even on this new efficient frontier, you still need to carefully consider the right risk-adjusted returns that suit your investment goals. It’s always important to look at your overall portfolio. It’s never too late to make changes and right the course of your ship. Perhaps it’s time to reevaluate your portfolio?

About Heeten Doshi

Heeten H. Doshi, CFA, is the founder of Doshi Capital Management and the portfolio manager of the Doshi Systematic Strategy Fund. Previously, Heeten was a senior equity strategist for Brown Brothers Harriman’s Portfolio Strategy team, where he focused on the US economy and equity market. Prior to that, he worked at Morgan Stanley as a research analyst where he conducted deep-dive fundamental company analysis and at Lehman Brothers where he was a fixed income derivatives trader. Heeten has received master’s degrees from Babson College and the University of Illinois. He has received his bachelors from Rutgers University and is a CFA charter holder.

About Doshi Capital Management

Doshi Capital Management is an independent investment management firm founded in 2011 based on the fundamental principle that investors should be able to generate positive absolute returns in any market environment. Doshi Capital Management relies on its decades of extensive research into understanding the different market cycles and the cause-and-effect relationships that drive asset prices. Our strategies seek to capture returns in both up and down markets, while minimizing portfolio volatility and downside risk.

For more information, please contact us at 866-DCM-2011 or info@doshicapm.com