Last year, we witnessed one of the quickest stock market recoveries following one of the briefest bear markets in history. The market continued to surge throughout the year, perplexing investors who were mired in a global pandemic and facing what was shaping up to be the worst economic downturn since the Great Depression.

Many in the financial media raised concerns over a stock market seemingly detached from reality, sparking more fear that the recovery could not last. But this is the very thing investors get wrong about the stock market. The stock market’s reality is not necessarily today—it’s six to 12 months from now.

Why the Stock Market is Often Detached from Today’s Reality

Many investors fail to grasp a fundamental stock market principle—that it is forward-looking whereas the current economic data they see in the headlines is essentially backward looking.

You’re probably familiar with the phrase, “the economy is not the stock market, and the stock market is not the economy,” which may be valid to the extent that the two don’t always move in lockstep. But they are interrelated. The mistake many investors make is focusing on the absolute here and now—reacting solely to today’s headlines without taking time to understand the implications of the data for future trends.

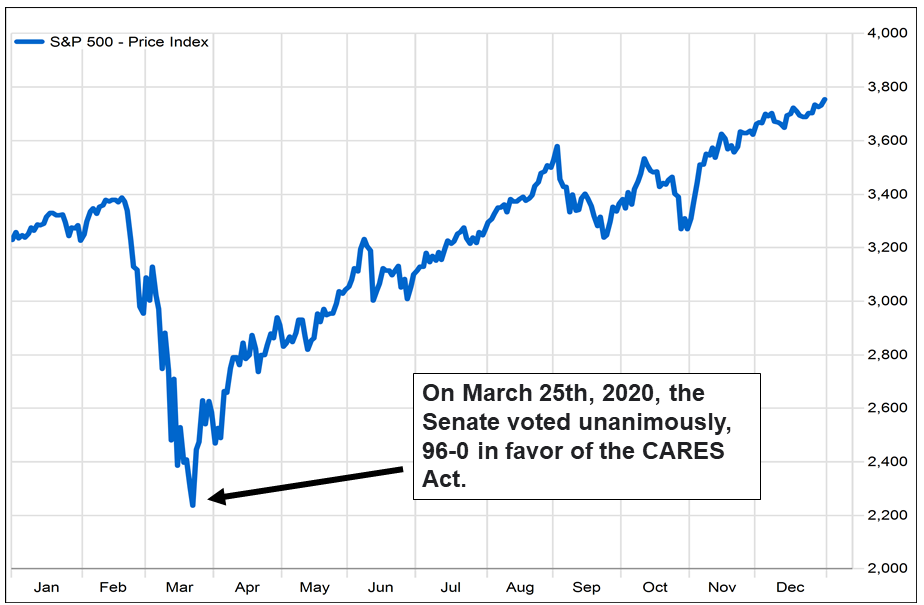

As we saw in February 2020, the stock market reacts quickly to news, as the S&P 500 plunged 34% in just over a month.

It did so on the realization that lockdowns would lead to massive unemployment and an economic recession. The full extent of the economic carnage caused by the lockdowns wasn’t yet fully known at the time, but the market was anticipating a severe and enduring downturn that would rival the Great Recession.

Just over a month later, the market turned, almost on a dime, to begin a historic recovery that would lead to record highs later in the year. How was that possible?

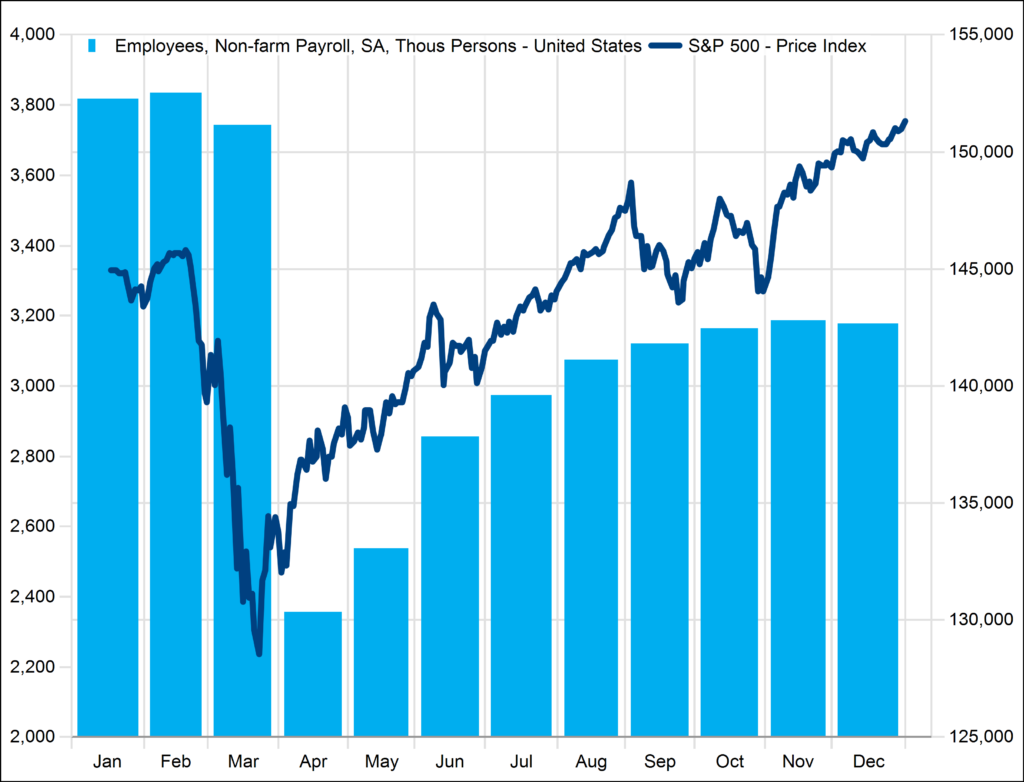

By mid-April 2020, the unemployment numbers were devastating, tallying more than 16 million people filing for benefits for the first time. The unemployment rate shot up to almost 10%, yet the stock market had already recovered 25% of its losses. By September 2020, the market was up nearly 60% from the March bottom even though 13 million people were still unemployed.

What was the market seeing that defied the realities on the ground?

The Stock Market’s Discounting Mechanism

While the stock market may react immediately to good or bad news, it is constantly adjusting in anticipation of changes in the economy six to 12 months from now.

The stock market acts as a discounting mechanism by digesting all available information in real-time and discounting future asset values to their present value as represented by current stock prices. This discounting in financial terms is called “priced in”. Priced-in means that the current or upcoming news event / economic release is already reflected in the current prices. Professional stock market participants are continually assessing the stream of information and analysis that forecast future asset valuations.

In February 2020, it took the stock market just over 30 days to apply its mechanism to quickly price in the damage that might be caused by the pandemic and ensuing lockdowns. Then, on March 25, the details of the first COVID-relief legislation was released, which changed expectations triggering the market turnaround.

MARKET REACTS TO THE CARES ACT

The market turned from focusing on the here and now to focusing on the future. The market quickly priced in the impact of the COVID stimulus package and the near-term economic relief it would provide over the next 6 to 12 months.

While many investors were still mystified by the market’s detachment from the current reality, what they missed is the market’s expectations for an improving economic backdrop. Declining death rates, new therapeutics and promising vaccine developments along with hopes of even further fiscal and monetary support continued to provide fuel to the market rally.

The market is always forward-looking.

What Investors are Missing: The Second Derivative

With the stock market, it’s not always about good vs. bad news. Although the market does care about today’s headlines, it cares more about whether things are getting better or worse. A worsening economic backdrop can send the market into a tailspin.

But when new data comes along, indicating things have capitulated, such as less dire employment numbers, the market will respond accordingly. That new data, which is not as bad or not as good, is what’s called the “second derivative.”

The second directive is a calculus concept that can be applied to the economy. In essence, it is a measure of the rate of change of velocity, either increasing or decreasing, with respect to time.

As it relates to the economy today, the second derivative can be an indication of whether things are improving or worsening. For instance, when the market declined in March 2020 based on a forecast of bleak unemployment numbers, it rallied further when it became apparent that the numbers were no longer getting worse.

The unemployment data in May 2020 was a second derivative—an indication that things had turned the corner and the data had reached a nadir. While the absolute numbers continued to show an economy in ruin, the market interpreted the “not as bad” employment data as a sign that the worst was behind us and expectations of an improving outlook.

THE S&P CONTINUED TO RALLY AS RELATIVE DATA OUTWEIGHED ABSOLUTE

Even now, as the lockdowns continue, COVID cases are increasing, and unemployment remains high, the stock market is looking out six months to one year focusing on the vaccine rollout and its implications for future economic growth.

Be Mindful of the Market’s Future Expectations

2020 was just one example of how many investors get the stock market wrong. In making investment decisions, investors are not wrong to focus on the here and now, however, they would be better off focusing on the “relative” here and now by considering the implications of new data or policies and their impact on the market.

Investors need to always be mindful of how the market digests information, what is already priced in and what new data portends about the market’s future expectations.

About Heeten Doshi

Heeten Doshi is the founder of Doshi Capital Management and manages the firm’s equity marketing timing strategy, the Doshi Systematic Strategy Fund. Mr. Doshi was formerly a senior equity strategist at Brown Brothers Harriman, where he focused on the US economy, equity market and provided investment recommendations to global institutional clients including hedge fund, asset management and pension funds. Prior to that, Heeten worked at Morgan Stanley as an equity research analyst where he conducted deep-dive fundamental company analysis and at Lehman Brothers where he was a derivatives trader and hedged the firms $14bn fixed income portfolio. Heeten has received two graduate degrees – an MS in Accounting from the University of Illinois GEIS Business School and an MS in Management from Babson F.W. Olin Graduate School of Business. He has also completed the Asset and Portfolio Management program at the University of Pennsylvania Wharton School. He holds a Bachelor’s degree in Finance from Rutgers University and has obtained the CFA designation.

About Doshi Capital Management

Doshi Capital Management is an independent investment management firm founded in 2011 based on the fundamental principle that investors should be able to generate positive absolute returns in any market environment. Doshi Capital Management relies on its decades of extensive research into understanding the different market cycles and the cause-and-effect relationships that drive asset prices. Our strategies seek to capture returns in both up and down markets, while minimizing portfolio volatility and downside risk.

For more information, please contact us at 866-DCM-2011 or info@doshicapm.com