The case against active investing is that fewer and fewer active managers over time have been able to generate alpha. It questions whether it makes sense to invest in an approach where it is becoming harder to generate returns over a benchmark.

This is what underpins the case for passive investing. The reasoning is that if it is so hard to beat the benchmark, then why try?

Well, let’s take another example. If you start a new business, you will need determination, tenacity, and the mental stamina to withstand the pressure. It’s a constant learning experience and you will most likely end up working unbelievable hours. Yet, after all that, there is a good chance that you will fail.

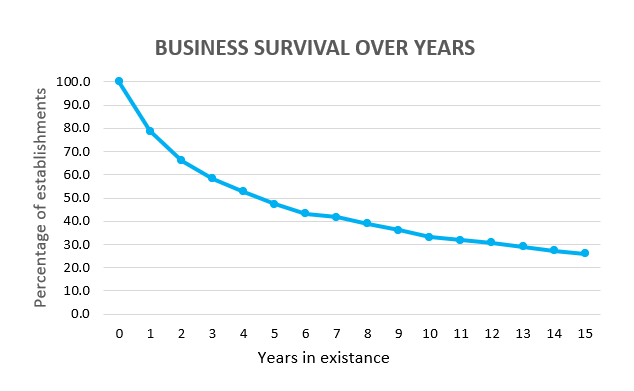

Sorry to put a dampener on things but this is true. According to the U.S. Bureau of Labor Statistics, 25% of new businesses go bankrupt within two years. This rises to 45% within five years, which is depressing. Take a look at the chart below!

Should entrepreneurs quit while the going is good?

Of course not! If you are an entrepreneur, you’re incredibly important to the future health of the economy.

In short, there are risks that are worth taking. There are benefits from these risks that can reward you financially and have a positive impact on society. That’s why investing matters, whether it’s with an entrepreneur or an established blue-chip company.

You can’t do this from the side-lines and you can’t do this passively. If you want to turn your dreams into reality, it is not going to be done as a passive observer.

Source: Bureau of Labor Statistics, Business Employment Dynamics

Stock Picking is a Zero-sum Game

What you need to remember is that if you are buying a stock then someone has to be on the other side of that trade. Not all investors can be right and therefore investment selection is very important.

In the 1980s and 1990s, investment flows were mostly institutional versus retail. Now, almost 80% of investing is done by institutions. They are effectively betting against each other. So, it is quite unfair to take an average of all funds in the “active” category when they are playing against each other.

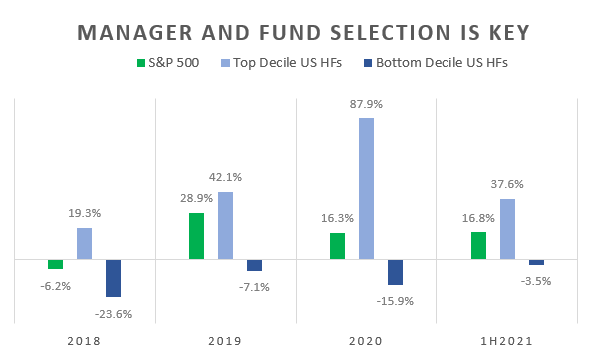

As you can see below, looking back over the past three and a half years, there is a wide divergence between the top and bottom decile performing hedge funds in the US. The chart below looks at the median performance. What should be clear is that active investing significantly outperforms passive investing.

However, the key is selection. Anyone who wants to generate alpha knows that picking the right stock is crucial. Picking the right manager is no different.

Source: Morningstar

The Conventional Wisdom on Passive Investing is Wrong

There is a popular story on passive investing, which needs to be debunked. It begins with a blindfolded monkey who throws darts and beats humans at stock picking.

The idea came from Princeton University economist Burton Malkiel who believed that asset prices follow a random walk. To prove his point, he said that “a blindfolded monkey throwing darts at a newspaper’s stock listings should do as well as any investment professional”.

I think he meant it as a joke, but ever since then as ridiculous as it seems, this idea has been added to the conventional wisdom behind passive investing.

The Wall Street Journal even decided to test his theory. In 1988, they pitted investment professionals against their own staff (who simulated the monkey throwing darts). Then in 2001, 13 years later, they released their results.

Investment professionals won 61 times per 100 contests. The journal then concluded that after the cost of researching, trading and paying taxes, any added value created by investment professionals was lost.

The report caused a bit of a stir. There was just one problem. It’s completely wrong.

Beware of Herd Mentality

Nobody uses monkeys to make investment decisions. That’s like spinning a wheel or rolling some dice. It’s ridiculous from a risk perspective. The whole idea of investing is to take advantage of opportunities where the odds are stacked in your favor. Otherwise, you might as well go out and buy a lottery ticket where the odds are certainly not in your favor.

In the past, when the study was conducted, portfolio managers did actually underperform the index, partly because they chose to.

For instance, it was safer for portfolio managers not to follow their conviction during the tech bubble. Even if they knew it was a bubble, being a contrarian in that type of environment could have got you fired because you would be going against the market.

For a long period of time, portfolio managers didn’t follow their conviction because there wasn’t much upside. You would get paid a standard annual management fee regardless of whether you made or lost money. It was just safer to hug the benchmark.

This isn’t active investing. So, comparing a monkey against lazy portfolio managers isn’t going to reveal anything. The problem was not a lack of skill among portfolio managers, but rather structural problems with how the asset management industry operated.

This is exactly why the hedge fund industry emerged. It wasn’t because hedge fund managers were investment geniuses. They were just remunerated well for taking calculated risks that might reward. The problem was they also charged too much, and eventually the industry attracted some also not so talented portfolio managers.

Neither passive nor active investing is bad

Most people compare passive and active investing as a one for one substitute. Unfortunately, this is far from true.

Passive investing should always have a place in someone’s portfolio. Passive and active investing are pieces of the same pie. Active investing, especially alternative investments like hedge funds, should be used to diversify a portfolio and generate alpha.

For decades, fixed income has been a mainstay of investors’ portfolios to diversify risk. With interest rates so low and inflation on the rise, the long-term outlook for bonds is dire. Additionally, when rates are this low, convexity is high, which makes bonds more risker than they appear. During periods like this, you need an active approach to diversifying your portfolio. You also need to look for alternative sources of risk premium.

Why Investors are Flocking Back to Hedge Funds

The Financial Crisis twelve years ago saw more than 11,600 hedge funds shut between 2008 and 2020 according to Hedge Fund Research Inc. Meanwhile, huge amounts of liquidity have been pumped into the market since then thanks to the U.S. Federal Reserve and its asset purchase program. The passive industry did extremely well during this period because there was so much asset inflation, yet very low stock market volatility. Everything just rose upwards.

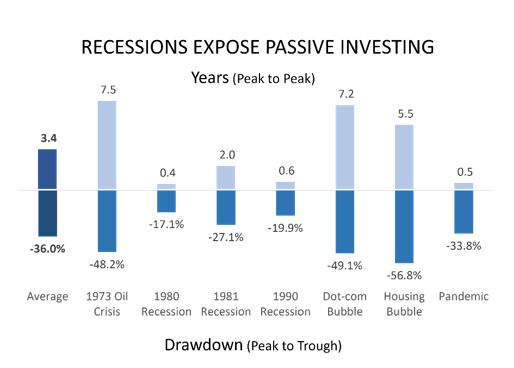

However, times have changed. Yields are so low and returns so difficult to come by from sticking to a passive strategy that it just doesn’t make sense to only invest passively. Investors need more return for the risks they face. And these risks are building up as I highlight with bonds. Markets can only rise so high before they need to correct. If you look back at recessions over the past 50 years, the average recession had a 36% drawdown and took over 3.5 years to break even. The last two cyclical recessions, which I remember, had 50% drawdowns and took over half a decade to recover. That is a long time to wait to recover your losses and why I launched our systematic market timing hedge fund.

Source: NBER, Factset

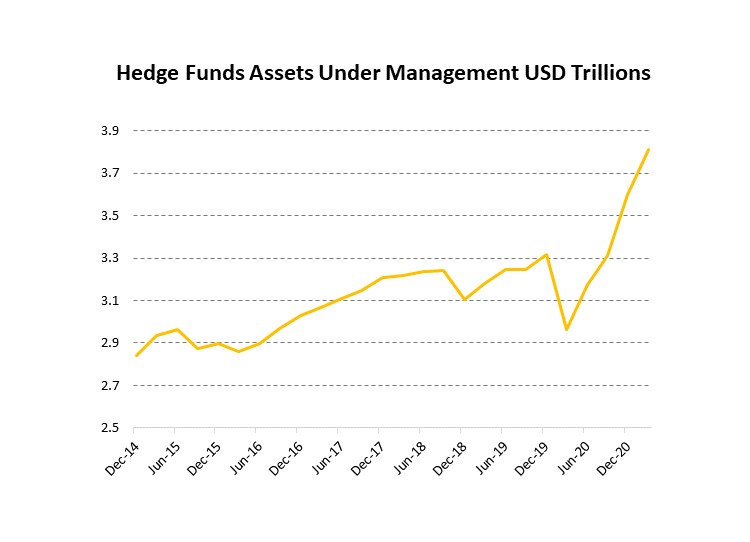

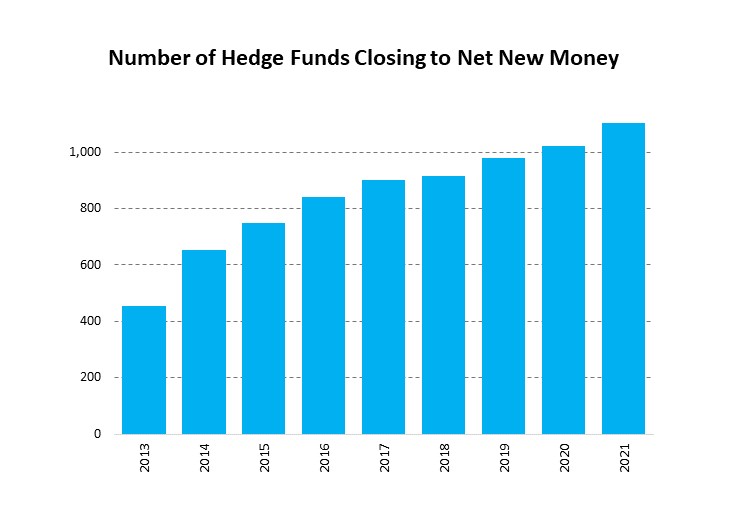

Most investors have begun to realize this, which is why the hedge fund industry is making such a strong comeback. Investors want alpha and a way to manage risk. Assets under management among hedge funds have shot up and they could surpass four trillion dollars this year. There is also a record number of hedge funds closing themselves to net new money.

I don’t find this that surprising. The 34% drawdown in just two months during the pandemic reminded everyone of the risks that passive investing entails. Fear always makes us re-evaluate our position and correct course.

|

|

|

Source: Prequin |

Source: Hedge Fund Research Inc. |

Active Investing is the Hammer, Passive in the Nail

Be aware that passive investing does bear an opportunity cost.

If you invest in an ETF or an index product, it doesn’t matter how small the fee you are paying. This tiny fee will eat away at your performance because it compounds over time, placing you persistently below the index.

These investment products are not designed to help you protect your wealth or diversify your portfolio. They are there to give you broad exposure to the market, whether it goes up or down.

Passive investing gives you no control over your destiny. If you one day want to retire, put your kids through college or pay off your mortgage you are going to actively need to take control over your future wealth.

This requires actively following your convictions and believe in every single investment you make. It’s not just about allocating. It’s also about deciding when and how you want to invest in a business you believe in. Passive investing therefore, is an instrument rather than a solution. It is a fallacy to suggest otherwise.

About Heeten Doshi

Heeten H. Doshi, CFA, is the founder of Doshi Capital Management and the portfolio manager of the Doshi Systematic Strategy Fund. Previously, Heeten was a senior equity strategist for Brown Brothers Harriman’s Portfolio Strategy team, where he focused on the US economy and equity market. Prior to that, he worked at Morgan Stanley as a research analyst where he conducted deep-dive fundamental company analysis and at Lehman Brothers where he was a fixed income derivatives trader. Heeten has received two master’s degrees from Babson College and the University of Illinois. He has received his bachelor’s from Rutgers University and is a CFA charter holder.

About Doshi Capital Management

Doshi Capital Management is an independent investment management firm founded in 2011 based on the fundamental principle that investors should be able to generate positive absolute returns in any market environment. Doshi Capital Management relies on its decades of extensive research into understanding the different market cycles and the cause-and-effect relationships that drive asset prices. Our strategies seek to capture returns in both up and down markets, while minimizing portfolio volatility and downside risk.

For more information, please contact us at 866-DCM-2011 or info@doshicapm.com