What Is Going on with the Bond Market? Well here is your answer.

Over the past several months interest rates have come in quite a bit, with the 10 Year moving from a high of 1.765 on March 30 to roughly 1.50 right before the FOMC announcement. The 10 year then spiked to 1.60 on the announcement before collapsing 15bps in the next 2 days. So what happened?

U.S. 10 Year Treasury Note Yield – Chicago Board of Exchange

The market was believing the Fed’s stance on inflation being transient or transitory. Many of the items in the monthly CPI figures were goods that faced supply/demand bottlenecks, in line with the Fed’s view of temporary inflation. So, despite rampant inflation numbers, the overall equity market remained near ATHs. Since mid-May, the 10YR breakeven inflation rate has been coming down.

US 10 Year Breakeven Inflation Rate

* The 10 year breakeven rate measures the difference or gap between 10 year Treasury Bond and Treasury Inflation Protected Securities (TIPS). The 10 year breakeven rate serves as an indication of the markets’ inflation expectations over the 10 year horizon. (google).

The market was expecting the Fed to be slightly hawkish with talk of tapering its bond purchase as other central banks have done. The market was comfortable with this move to reel in inflation.

The market was not expecting the Fed to be very hawkish in moving up its timetable of raising interest rates. Especially with the Fed’s Bullard saying the Fed may hike rates in 2022!

So the question everyone is asking, if the Fed is even more hawkish, isn’t that bearish for rates?

The answer:

The market believes the risk of prematurely raising rates and causing an economic slowdown or another recession is greater than the threat of inflation. The bond market firmly believes that the economy can not sustain without the unprecedented amount of stimulus being thrown into the economy. If the bond market now fears the risk of an economic slowdown or even worse a recession, it would make sense for rates to decline as a safe haven asset.

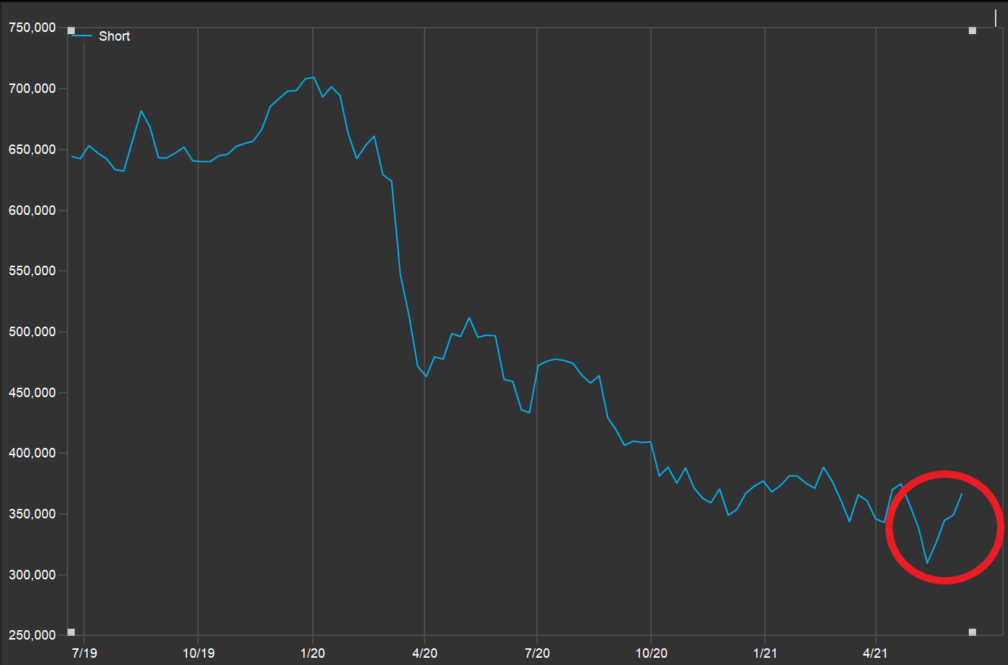

Over the past month money managers were positioning increasingly bearish in US Long-term Bonds ahead of the Fed announcement. What we saw over last 2 days was partially a short squeeze as managers were positioned on the wrong side, which exacerbated the move in rates.

Short (Term U.S. Treasury Bonds) – Chicago Board of Trade Commitment of Traders

About Heeten Doshi

Heeten H. Doshi, CFA, is the founder of Doshi Capital Management and the portfolio manager of the Doshi Systematic Strategy Fund. Previously, Heeten was a senior equity strategist for Brown Brothers Harriman’s Portfolio Strategy team, where he focused on the US economy and equity market. Prior to that, he worked at Morgan Stanley as a research analyst where he conducted deep-dive fundamental company analysis and at Lehman Brothers where he was a fixed income derivatives trader. Heeten has received master’s degrees from Babson College and the University of Illinois. He has received his bachelors from Rutgers University and is a CFA charter holder.

About Doshi Capital Management

Doshi Capital Management is an independent investment management firm founded in 2011 based on the fundamental principle that investors should be able to generate positive absolute returns in any market environment. Doshi Capital Management relies on its decades of extensive research into understanding the different market cycles and the cause-and-effect relationships that drive asset prices. Our strategies seek to capture returns in both up and down markets, while minimizing portfolio volatility and downside risk.

For more information, please contact us at 866-DCM-2011 or info@doshicapm.com